| Purpose |

| Overview |

| Scope |

| Details |

| Functionality |

| Setup |

| Processing Options |

| Data Selection |

| With performance 9.1 Bug 17533200 applied or at release 9.2 and later: |

| Reviewing the Report |

| Resolving the Integrity |

| Frequently Asked Questions |

| Question 2: Why were the processing options changed for the R09705 report beginning in 8.10? |

| Question 3: What is the difference in functionality between the Account Balance to Transaction Report (R09705) and Repost Account Ledger Report (R099102)? |

| Question 4: Why is the Account Balance to Transaction Report (R09705) printing "No Data Selected" when no integrity issue is found rather than just a blank page? |

| Question 5: Why is R09705 failing with ERROR: Memory allocation failed? |

The Account Balance to Transaction Integrity Report (R09705) assists in locating out-of-balance conditions in the system by identifying imbalances between the Account Balance F0902 and Account Ledger F0911 tables on a period-by-period basis.

This document provides an overview of the Account Balance to Transaction Integrity Report (R09705) including the overview, program functionality, setup, information on reviewing and resolving the integrity report, reasons for integrity and frequently asked questions.

The Account Balance to Transactions report reviews each account balance in the Account Balance (F0902) table, verifies the amounts against the total of all posted transactions in the Account Ledger (F0911) table, and prints any out-of-balance conditions by period. It summarizes F0911 totals by ledger type, account number, century, fiscal year and period number.

It reads the F0902 first and if an F0902 record exists, it compares the balance to the total of the corresponding posted F0911 transactions. This report also identifies Account Balance (F0902) amounts that do not have supporting Account Ledger (F0911) detail.

If no F0902 record exists for an account, the program will not check the F0911 for that account.

Releases Xe, ERP 8.0 and 8.9:

This integrity only prints the imbalances found between the F0902 and F0911 tables and does not perform any updates.

Release 8.10 and later:

If this integrity report does not locate F0911 records with the same account number, period number, fiscal year, and ledger type as the F0902 records, it deletes the invalid period balance from the F0902 table, if the following conditions apply:

If the Account Balance to Transactions report locates F0911 records with corresponding F0902 records, the system does not delete invalid period balances from the F0902 table, regardless of the processing option and ledger type master setup.

Releases Xe, ERP 8.0 and 8.9:

Prior to 8.10, the only processing option available is for the selection of a specific ledger type (if not specified in the data selection).

Ledger Type Tab

Ledger Type: If comparing a units ledger, enter the amounts ledger to use to retrieve the transaction records.

Release 8.10 and later:

Select Tab

Exclusive Data Selection Values:

1. Company

2. Ledger Type

3. Fiscal Year

4. Beginning Period Number and 5. Ending Period Number

6. Business Unit

7. Beginning Object Account and 8. Ending Object Account

Options Tab

1. Clear invalid period balances

2. Exclude inactive accounts

Units Tab

1. Amount Ledger Type

Releases Xe, ERP 8.0 and 8.9:

In releases prior to 8.10, Compare Account Balance to Transactions (R09705) allows data selection only for limited criteria:

All data selection for these prior releases are based on the Account Balances (F0902) table.

Release 8.10 and later:

Beginning with the 8.10 release, a new workfile Account Balance Compare Exceptions (F09UI016) has been created which is used by the UBE report to assist with more efficient processing. The data selection is changed to be based on the F09UI016 instead of the F0902. However, any defined data selection is completely ignored. All items that can be selected in order to improve performance or narrow selection criteria must now be chosen via the R09705 processing options only:

Select Tab

The first three processing options on the Select tab would be the standard data selection in prior releases (Company/Ledger Type/Fiscal Year). The remaining items enhance a user's ability to narrow selection criteria in order to decrease processing time of this Integrity Report.

Additional setup is required to reset cache as the R09705 is running otherwise ERROR: Memory allocation failed could occur.

1. In EnterpriseOne System Control (P99410) verify data item TBLREFR with the radio button is set to Yes otherwise this row needs to be added.

2. In UDC 00/RF Add the following UDC: Code R09705, Description 01 of Compare Account Balances To Transactions, Description 02 of F0901, Special Handling Code of 11.

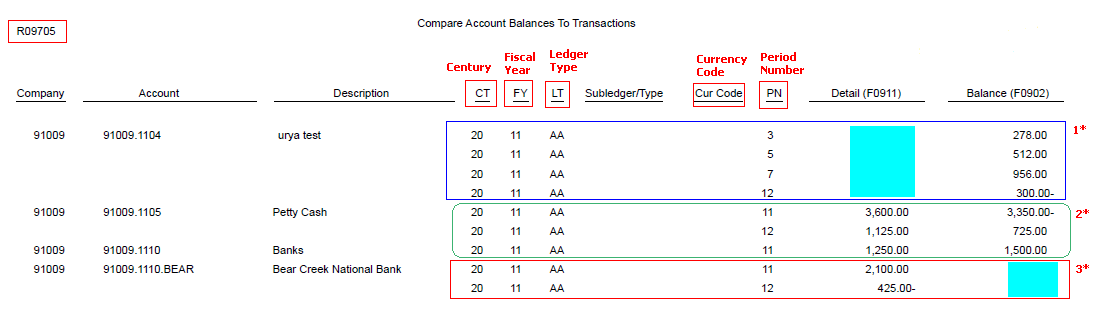

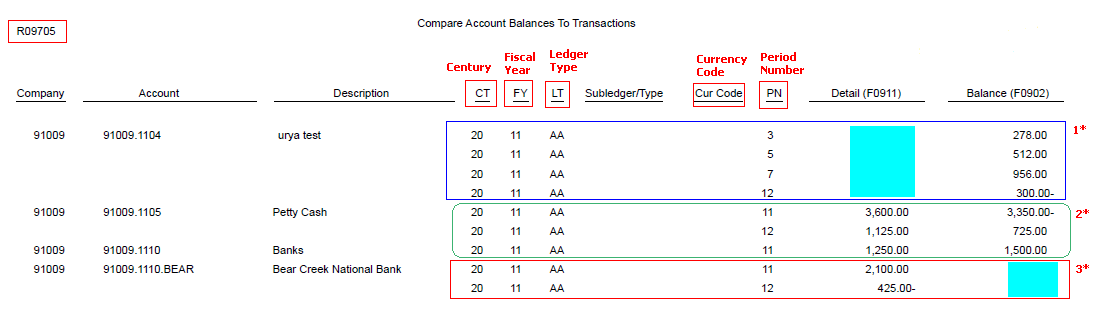

1* The integrity report does not find supporting F0911 records with the same account number, period number, fiscal year, and ledger type as the F0902 records, hence it shows the Account Ledger F0911 as Blank whereas F0902 Account Balances exist.

2* The integrity report verifies and prints a mismatch between balances of the F0902 and corresponding F0911 records for the following criteria:

3* The report does find a F0902 record for the account 91009.1110.BEAR but with F0902 amounts updated as zero for multiple periods, whereas the corresponding F0911 transactions have accumulated balances as non-zero, hence the report prints the discrepancy. If no F0902 record existed for this account, the program would not have checked the F0911 for the same account, hence it would not print a discrepancy in this case.

The first step in resolving the issues on the Integrity Report would be to export and review the data to compare the amounts from the F0911 and F0902 tables as follows:

Filter the F0911 table on the following fields:

Posted Code (GLPOST), Company (GLCO), Account ID (GLAID), Ledger Type (GLLT), Century (GLCTRY), Fiscal Year (GLFY), Period Number (GLPN)

Append Subledger Value (GLSBL), Subledger Type (GLSBLT) to the above selection, if applicable.

Filter the F0902 table on the following fields:

Company (GBCO), Account ID (GBAID), Ledger Type (GBLT), Century (GBCTRY), Fiscal Year (GBFY)

Append Subledger Value (GBSBL), Subledger Type (GBSBLT) to the above selection, if applicable.

1* To correct this error, select the Prevent Direct Balance Update option in the Ledger Type Master Setup program (P0025) for any ledger type that should not allow data entries directly to the F0902 table. Then run the Account Balance to Transactions report (R09705) with the Clear Invalid Period Balances processing option set to '1' to delete invalid balances from the F0902 table.

2* and 3* Run the R099102 Repost Account Ledger program Overview Repost Account Ledger Integrity Report (R099102) to update existing F0902 amounts with correct F0911 accumulated amounts.

Some typical discrepancies, causes, and possible resolutions of similar scenarios are listed as follows:

| Discrepancies | Reasons | Resolutions |

|---|---|---|

| Account Balance and Detail Columns are Out of Balance | Data entries were damaged by improper void or revision processes. | If data entries are damaged in the F0911 table, run a data utility program. If data entries are damaged in the F0902 table, run the R099102 Repost Account Ledger program. |

| Account Balance and Detail Columns are Out of Balance | An entry was not properly created by the conversion/interface programs. | Research the error and add the missing entries. Verify the validity of Account Ledger F0911 records and correct the conversion/interface programs. |

| Balance Column Has an Amount and Detail Column Does Not Have an Amount | This error appears if entries were made directly to the F0902 table. | To correct this error, select the Prevent Direct Balance Update option in the Ledger Type Master Setup program (P0025) for any ledger type that should not allow data entries directly to the F0902 table. Then run the Account Balance to Transactions report with the Clear Invalid Period Balances processing option set to 1 to delete invalid balances from the F0902 table. |

| Date Pattern is Incorrect | This error appears if changes were made to the fiscal date pattern after journal entries were entered in the system. | If the date pattern of the prior company is different from the new company, run the R099102 Repost Account Ledger program with the processing option set to print only the report. After reviewing the report, run the R099102 program with the processing option set to recalculate the amounts to correct the fiscal period and year balances. |

To prevent future out-of-balance conditions, consider:

Answer 1: This scenario may happen because of following reasons:

Answer 2: In releases prior to 8.10, Compare Account Balance to Transactions ( R09705) allowed data selection only for limited criteria. This could be by Ledger Type, Company, and, depending on the software level of R09705, may also include data selection by Fiscal Year ( a performance enhancement change so that R09705 would not have to query every fiscal year). All data selection for these prior releases was also based on the Account Balances ( F0902) table. While the report allowed data selection on other items, such as a specific period or Account ID, data selection on any item other than Ledger Type, Company or Fiscal Year was not recommended as the results of the UBE would be misleading. Also prior to 8.10, the only processing option available was for the selection of a specific ledger type (if not entered in the data selection).

Beginning with 8.10, data selection for R09705 was changed to be based on the Account Balance Compare Exceptions table ( F09UI016) table instead of the F0902, and is completely ignored. All items that can be selected in order to improve performance or narrow selection criteria must now be chosen via the R09705 processing options.

Answer 3: Both R09705 and R099102 read and compare the Account Ledger (F0911) and Account Balances (F0902) files for accumulated ledger amounts but have following differences:

The R09705 reads the F0902 file first and then F0911. If no F0902 record exists for an account, it goes on to the next account. If it finds the F0902 record, then it looks for corresponding F0911 record, whereas R099102 reads the F0911 file first. If no F0911 record exists for an account, it goes on to the next account. If its finds the F0911 record, then it looks for corresponding F0902 record.

The R09705 in prior releases (Xe, ERP8.0 and 8.9) had no ability to update amounts. Beginning in release 8.10 and subsequent, it can clear F0902 invalid balances, which do not have a corresponding F0911 records. The R099102 can be run in final mode to update F0902 Balances with posted F0911.

Example: If account 1.1110.BEAR has an AA ledger amount in the F0911 of $100 and an amount in the F0902 for $200 for period 8 of 2008, this condition would appear as an exception on both the R09705 and R099102 reports. But to correct this, only the Repost Account Ledger would update the F0902 amount with the F0911 amount ($100).

For more information on R009102, refer to Overview Repost Account Ledger Integrity Report Overview of Repost Account Ledger Integrity Report (R099102).

Answer 4: Beginning with 8.10 release, the data selection has been changed to be based on the Account Balance Compare Exceptions table (F09UI016) table instead of the Accounts Balances (F0902), but is still completely ignored. All items that can be selected in order to improve performance or narrow selection criteria must now be chosen via the R09705 processing options.

The R09705 report throws "No Data Selected" only when the report does not find any data in the F09UI016 work file which is written only when there are discrepancies between F0902 and F0911. Hence if no discrepancies exist between F0902 and F0911, the system does not create any records in the F09UI016 work file, hence report prints the error message.

For more information on the same, you may refer to Bug 10998040 which has been returned by Development as working as designed.

Answer 5: Refer to Setup and required performance setup.