| Purpose |

| Scope |

| Details |

| Pay When Paid Vouchers (R03B470/P03B470) |

| Understanding Pay When Paid Setup |

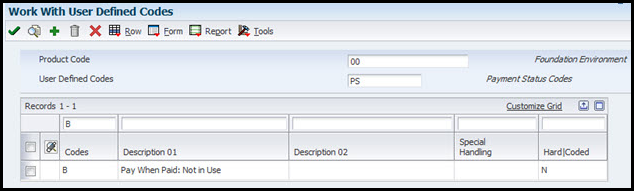

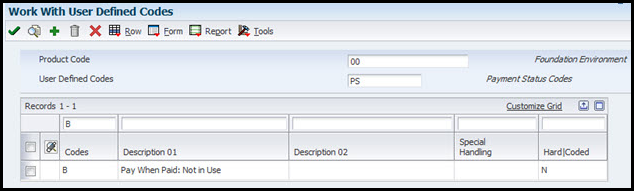

| Voucher Payment Status Code Setup (UDC 00/PS) |

| Next Numbers Setup (P0002) |

| Customer Master Setup (P03013) |

| Accounts Payable Constants Setup (P0000) |

| Subcontractor Threshold Setup (P4355) |

| Important Pay When Paid Processing Options in the Voucher Entry Master Business Function (P0400047) |

| Important Pay When Paid Processing Options in Standard Voucher Entry (P0411) |

| Important Pay When Paid Processing Options in Voucher Match (P4314) |

| Entering Pay When Paid Vouchers |

| Manually Create and Revise Pay When Paid Groups |

| Steps to Manually Create a Pay When Paid Group |

| Steps to Add Vouchers or Invoices to a Pay When Paid Group |

| Steps to Remove a Voucher or an Invoice from a Pay When Paid Group |

| Steps to Remove All Vouchers and Invoices from a Pay When Paid Group |

| Release Pay When Paid Vouchers for Payment |

| Pay When Paid Integrity Reports |

| Frequently Asked Questions |

| Question 1: When attempting to open the Pay When Paid Manual Link program for the first time after an install, why does the system trigger a database failure error? |

This document provides an overview of Pay When Paid Within EnterpriseOne Accounts Payable.

This document is intended for users who are entering vouchers in the JD Edwards Accounts Payable module.

Pay When Paid is the practice of paying suppliers only after payment is received from customers. For example, a subcontractor (supplier) submits an invoice to you for payment, but first you need to receive payment from the customer for whom the work was done before the subcontractor can be paid. Therefore, with the invoice, you enter a voucher with a unique holding Payment Status (data dictionary item PST). A corresponding invoice is then created and sent to the customer. After a payment for that invoice is received, the voucher entered for the subcontractor is released and paid. Although Pay When Paid processing is helpful in managing cash effectively, it can be time consuming. JD Edwards EnterpriseOne automates this process. This document outlines how to configure and use the automated Pay When Paid functionality.

Before you can use Pay When Paid processing, you must complete the setup requirements discussed in this section.

To utilize the Pay When Paid automatic processing, a unique Payment Status Code (PST) should be created in UDC table 00/PS (Pay Status Codes) to signify Pay When Paid vouchers on hold. After the code is created in the UDC table, Processing Option 2: Pay Status Code on the Defaults tab for the Voucher Entry Master Business Function (P0400047) needs to reflect the correct code. For information on Pay When Paid voucher entry in the Procurement and Subcontract Management system, please see the Implementation guide for that module.

If not using Pay when Paid in A/P, you can create a new Pay status type 00/PS to represent that PWP is not in Use. Apply this new Pay status code in the Pay When Paid Release Pay Status field (PST) in the A/P Constants.

Corresponding Pay When Paid invoices and vouchers are linked together within a Pay When Paid Group Number (data dictionary item PWPG). This number is determined from line 7 in the Next Numbers program (P0002) for system 04 (Accounts Payable).

For all customers that will be associated with the Pay When Paid process, the Pay When Paid Cash Receipt Threshold (data dictionary item PWPCP) should be completed. This field is used to determine the amount that needs to be paid by that customer before the related Pay When Paid vouchers are released for payment. For example, if the Pay When Paid Cash Receipt Threshold is set to 50 percent and a corresponding Pay When Paid Group contains invoices totaling 50,000 USD, the system releases all vouchers in the group for payment only after cash receipts totaling at least 25,000 USD are applied to the invoices.

The Accounts Payable Constants program (P0000) has a setting (Pay When Paid Release Pay Status) that determines what Pay Status Code (PST) the system assigns to vouchers in a Pay When Paid Group that has been released using the Pay When Paid Automatic Release (R03B470) UBE. This field must be a Payment Status Code that the system selects for payment, such as A (Approved for Payment).

If Pay When Paid vouchers are entered in the Procurement and Subcontract Management system, a voucher's amount must exceed the subcontractor (supplier) Threshold Amount (data dictionary item ATHR) to be eligible for Pay When Paid processing. The Threshold Amount (data dictionary item ATHR) is specified per supplier in the Subcontractor Threshold (P4355) program. For example, if you set up a subcontractor threshold amount of 1,000 USD and then enter a voucher totaling 1,000 USD or less, the voucher is not eligible for Pay When Paid processing and the system does not create the voucher as a Pay When Paid voucher. If the voucher amount exceeds the subcontractor threshold amount, the voucher is eligible for Pay When Paid processing and the system assigns the payment status code that you specify in the Threshold Payment Status Code processing option in the Voucher Match program (P4314).

Voucher Entry Master Business Function (P0400047) processing options specify the default processing for the voucher entry program. The standard version of this program that is used for Pay When Paid Processing is the ZJDE00012. The following are just some of the more important processing options available for this program and are all located on the Defaults tab:

There are several versions of the Standard Voucher Entry (P0411) program that are specifically for Pay When Paid processing:

Below is an outline of some of the more important processing options for Standard Voucher Entry (P0411):

To enter Pay When Paid vouchers in the Procurement and Subcontract Management system, there are processing options that need to be adjusted in the Voucher Match application (P4314). These processing options specify whether the system processes vouchers that are entered in Procurement and Subcontract Management and that exceed the subcontractor threshold as pay when paid vouchers. The following are just some of the more important processing options available for this program:

After all of the required setup for the Pay When Paid process is complete, Pay When Paid vouchers can be entered using Standard Voucher Entry program (P0411). The steps to create Pay When Paid vouchers are the same as those for entering other types of vouchers.

Pay When Paid groups are comprised of at least one voucher and one invoice. The Pay When Paid Manual Link program (P03B470) can be used to review and revise existing Pay When Paid groups, or manually create new groups. The Pay When Paid Manual Link (P03B470) program has two processing options:

The Pay When Paid Automatic Release program (R03B470) uses the Pay When Paid Group Status (data dictionary item PWPS) field from the Pay When Paid Group Header table (F03B470) to select groups for processing. The system initially assigns the value of 1 (Inactive) to new Pay When Paid groups if no cash receipts are applied to the group yet. Groups with this Pay When Paid Group Status are not processed by the Pay When Paid Automatic Release (R03B470) program unless Processing Option 1: Inactive Groups is set to 1. When cash receipts are applied to invoices in a Pay When Paid group, the system set the Pay When Paid Group Status to 2 (Active). With the selected Pay When Paid groups, the Pay When Paid Automatic Release (R03B470) updates the Pay When Paid Group Status based on the related cash receipt percentages as defined in the Customer Master (P03013). If cash receipts have been applied to the invoices in a group and a minimum cash receipt percentage is defined in the Customer Master (P03013), the system summarizes the total of cash receipts and determines whether the minimum percentage is met. When the amount is lower than the minimum the system updates the Pay When Paid Group Status (data dictionary item PWPS) from 2 (Active) to 1 (Inactive). However, if the amount is greater than or equal to the minimum, the system:

If a minimum cash receipt percentage is not defined and there is at least one cash receipt applied to an invoice in the group, the system:

If a Pay When Paid group contains invoices for a customer that has different cash percentages defined by line of business, the system summarizes cash receipt totals based on the customer and company. Unless each customer and company combination in the group meets its related minimum cash receipt percentage, no vouchers are released.

The following integrity reports are key components to the Pay When Paid process:

Answer 1: Receiving an error of "JAS_MSG346: JAS database failure: [SQL_EXCEPTION_OCCURRED] An SQL exception occurred: Invalid object name CONVDATA.F03B470" when opening the Pay When Paid Manual Link application (P03B470) is generally caused by a failure to generate the Pay When Paid Group Header table (F03B470). To fix the problem, the table needs to be generated and then an update package deployed to the server.

Answer 2: Confirm that the data dictionary item PYWP has been setup as it is at Oracle. Most likely, the Edit Rule may need to be changed to "No Edit Rule". See Deploying Data Dictionary Changes on DD changes if needed.