| Goal |

| Solution |

| Setting Up Tax Vouchers and Payee at Company Level |

| Voucher Review |

| Transferring Vouchers to the A/P System |

How to Set Up and Process A/P Vouchers?

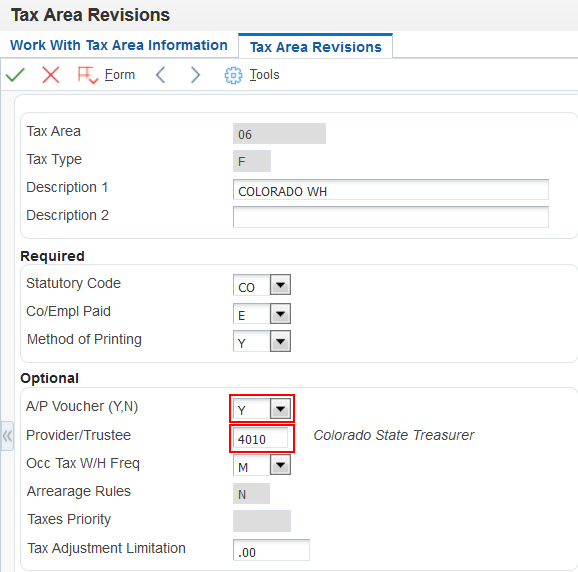

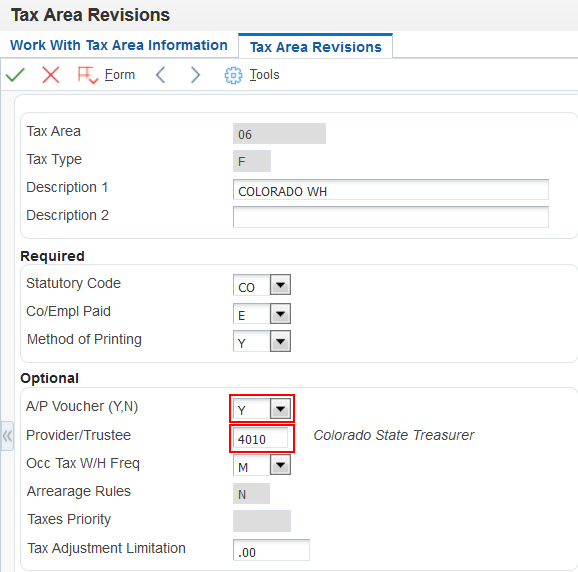

Activate Voucher Processing in Company Options (P05001C) Once the system has been set to create vouchers (Company Options level), vouchering must be activated for specific tax types and then payees need to be entered. Payees can be entered at the tax type level or at the company level. Entering payees at the company level is most efficient when all or most of the companies in an organization remit payment for a tax to the same taxing authority (Example: Federal Income Tax). Entering payees at the tax level is most efficient when all or most of the companies in an organization remit payment for a tax to the different taxing authorities. Note: Vouchers are not automatically created for workers compensation. Instead, run R773601 Worker's Comp Register during either Journals or Reports Only to get the worker's comp premium amount for the payroll, then manually create a voucher for this amount.

Setting Up Payee Voucher Rules Go to Payee Voucher Rules (P07927). Click FIND

- Voucher Rule 00-One voucher per payee (this is the default rule)

- Voucher Rule 01-One voucher per employee (use this rule for a payee for a wage attachment that was entered at the employee level.)

- Voucher Rule 02-One voucher per payee for each DBA.

- Voucher Rule 04-One voucher per payee for each group plan.

- Voucher Rule 00-One voucher per payee (this is the default rule).

- Voucher Rule 01-One voucher per payee by employee.

- Voucher Rule 02-One voucher per payee by tax type.

Review these reports or on-line forms; make any needed corrections before Final Update. The system will automatically process these reports again during Final update to create the actual voucher.

If there are any errors during final update when the system creates the journal entries for actual vouchers the system will send a message to the work center and vouchers will be stored in the F0411Z1 (Voucher Transactions Batch File).

The Creation Of Invoice Numbers

Invoice numbers are created on the A/P side as the voucher invoice is being created. The number derives from the following sequence: Payroll ID_Time_EDITtransNo. The use of the EDITtransNo ensures that there is no duplication of an invoice number within a specific Payroll ID batch. However if the invoice is for a voucher that is attached to a specific case, that number will then follow this following sequence: Invoicedate_CaseNumber.

Note: Within the Accounts Payable Constants (P0000) there is an option to set the system to hard, soft or no error if there is a duplicate invoice number. With the addition of the EDITtransNo to the invoice numbers, this can be set to a hard error without problems.

Voucher Reports

Batch Voucher Processor Report (R04011ZA):

Report R04110ZA will show any voucher errors. This is produced automatically when journal entries are run.

Payroll Voucher Journal Detail (R07493):

Use the Payroll Voucher Journal Detail report (R07493) to review detailed information about tax and DBA vouchers that are created during the payroll cycle. You can choose to print DBA vouchers, tax vouchers, or both types of vouchers on the report. The information that appears on this report is based on the Payroll - Accounts Payable Detail table (F07490). You can print this report during a payroll cycle only. The report can be run during the Journal Entries step (when they are created), Reports Only and/or Final Update, When run during Final Update the report will include the payment terms and pay items.

Payroll Voucher Journal Summary (R07496):

Use the Payroll Voucher Journal Summary report (R07496) to review summarized information about tax and DBA vouchers that are created during the payroll cycle. You can choose to print DBA vouchers, tax vouchers, or both types of vouchers on the report. The information on the report is summarized using the voucher rules that were used to create the vouchers. The information that prints on this report is based on the Payroll - Accounts Payable Summary File table (F07491). You can print this report during a payroll cycle only. The report can be run during the Journal Entries step (when they are created), Reports Only and/or Final Update, When run during Final Update the report will include the payment terms and pay items.