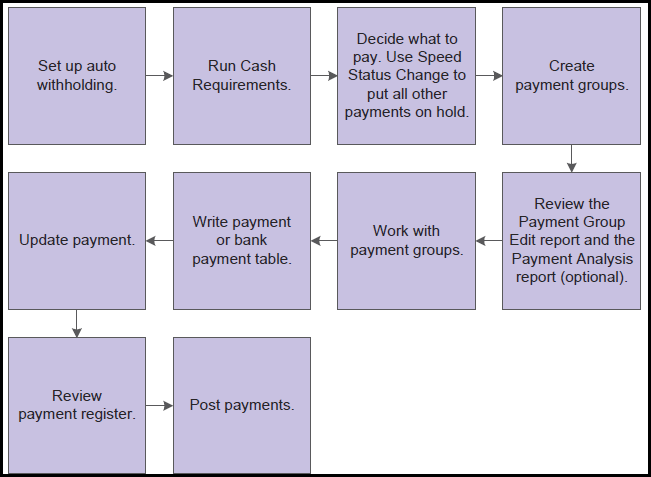

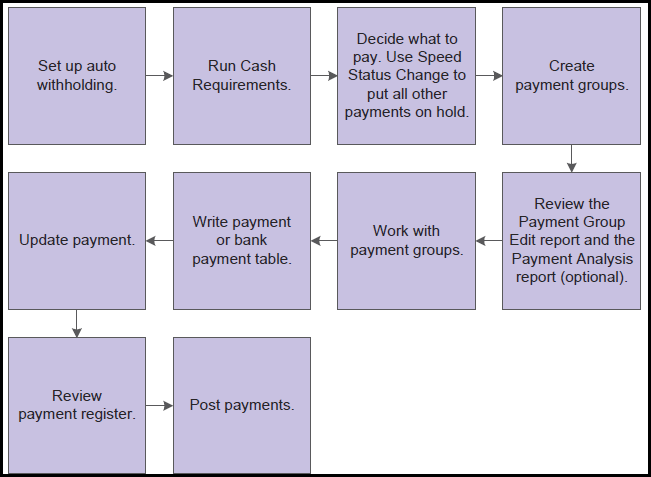

| Process Order |

Description |

Troubleshooting Knowledge Document |

1. Complete set up requirements

|

- Complete all required set up listed above to be able to create Automatic Payments.

|

- See "Automatic Payment Set Up Requirements" at the top of this overview document.

|

2. Supplier Balance Report (R7404002, R7404003)

|

- The Generate Supplier Balance AP (R7404003) populates the Supplier Balance Worktable (F74412) with supplier transactions. This information is then used when running the Supplier Balance Report (R7404002). The way information is grouped in the Supplier Balance Worktable (F74412) table determines how it is printed on the Supplier Balance Report (R7404002).

|

|

3. Use Speed Status Change To Update Voucher(s) (P0411s)

|

- Before creating payment groups, vouchers can be reviewed, modified, or released for payment in the Speed Status Change (P0411S) application.

|

|

4. Create a Payment Control Group (R04570)

|

- The Create Payment Groups (R04570) program selects open vouchers to be paid. Only vouchers with a Pay Status (data dictionary item PST) of A (Approved) are selected. the Speed Status Change (P0411S) application can be used to update a voucher's Pay Status (PST) from H (Held) to A (Approved). The processing options and data selection of the Create Payment Control Groups (R04570) should be used to limit the selection of vouchers to be paid. After a voucher is selected for a payment control group, its Pay Status (PST) is changed from A (Approved) to # (Payment in Process). The Create Payment Control Groups UBE (R04570) updates three temporary work files.

|

|

5. Write Your Payment Group and Review (P04571, R04571)

|

- Once a payment control group is created, next you need to WRITE the payments creating either a live physical check (payment) to Suppliers or creating a Electronic Funds Transfer text file. This process creates a PDF to review, print the checks before you complete the process. Consider this step 1 in Working the payment control group.

|

|

6a. Print Your Payments Or

|

- Print your payments to mail out to your Suppliers OR

|

|

6b. Print Debit Statements Or

|

- A debit statement is printed for negative payments and is used to notify suppliers when they have been overpaid. By assigning a program to the debit statement component, a separate debit statement form is printed with a payment. A debit statement is automatically generated if debit memos and open vouchers for a supplier net to zero or net to a negative total.

|

|

6c. Complete Electronic Funds Transfer (EFT/ACH) (F04572OW) Or

|

- Review your EFT/ACH text file in F04572OW to ensure it accurate to send to your bank for processing.

- Note - Here may be when you may want to use Positive Pay process as well.

|

|

6d. Complete EDI Outbound Payment Processing

|

- Using EDI "Electronic Data Interchange" is another format of EFT/ACH that is available as an option.

|

|

7. Update Your Payment Group (P04571, R04575)

|

- After you either print or file your payments electronically now you can Update your payment control group which moves the payment group from the temporary payment tables into the permanent payment tables so you can post them to your bank and A/P trade accounts.

|

|

8. Post Your Payment Batch (P09801, R09801)

|

- When you create a payment, after updating your automatic payment group and after creating your manual payment, you update the Payment header table (F0413) and Payment detail table (F0414) which stores the voucher detail information. Before posting this batch there is no data in the General Ledger table (F0911) created. After you post the payment batch, you update the payment header table (F0413) and paymente detail table (F0414) post status field (F0413) and post code field (F0414), if successful, to status of D and the General Ledger table (F0911) will create the payment record (PK or PN) with a post code status, if successful, of P and creates a AE entry for your AP trade account.

|

|