Overview

Electronic funds transfer (EFT) payments is the electronic exchange or transfer of money from one account to another, either within a single financial institution or across multiple institutions, through the Oracle JD Edwards EnterpriseOne Financial system. There are three EFT Payment Print Programs available within JD Edwards EnterpriseOne Accounts Payable. The formats include:

For release 8.12 and above the third format option is:

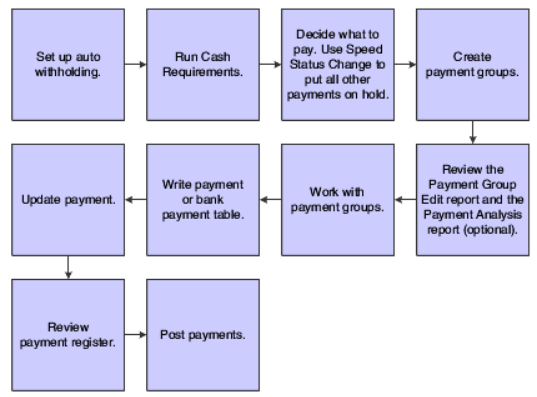

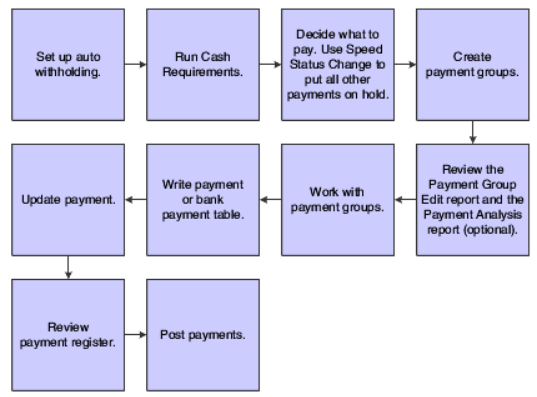

See graph below with a list of data preparation steps to create Automatic Payments.

Setup

Setup requirements for Electronic Funds Transfer, also known as ACH/Automatic Clearing House, include the following:

The setup steps for each of these above are listed below.

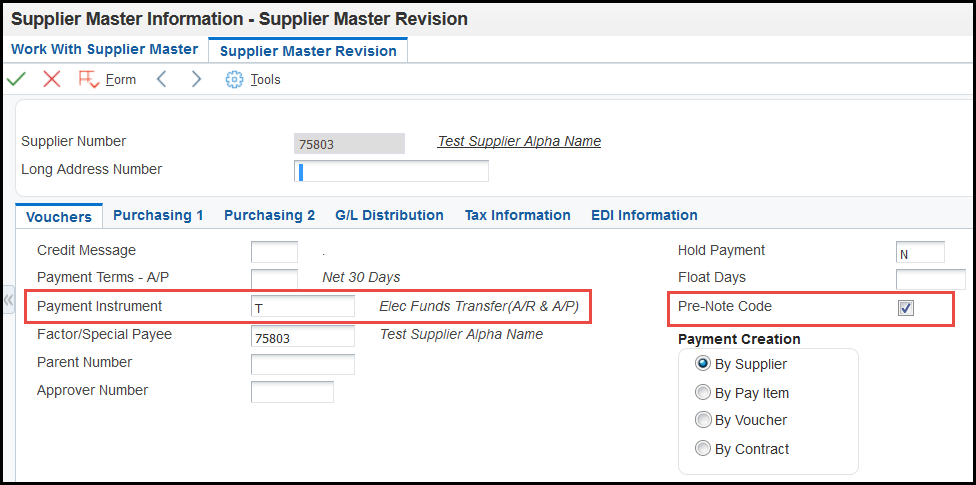

Supplier Master Setup (P04012)

Populate these fields:

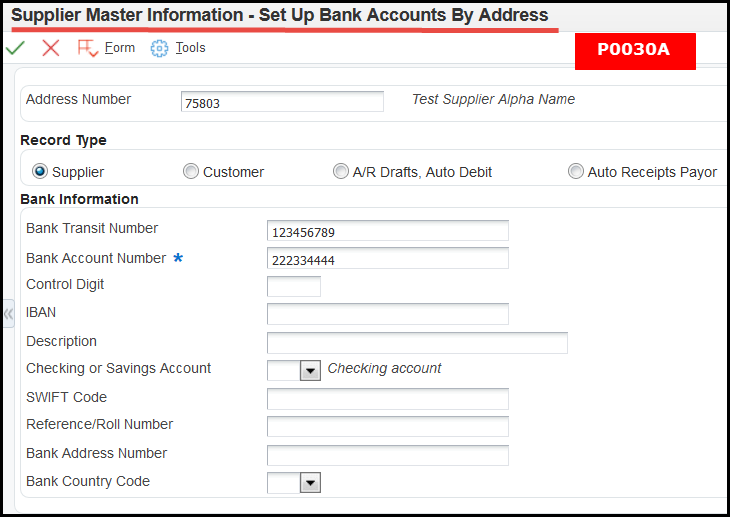

Every supplier paid using EFT needs to have a corresponding bank account in the Bank Accounts by Address (P0030A).

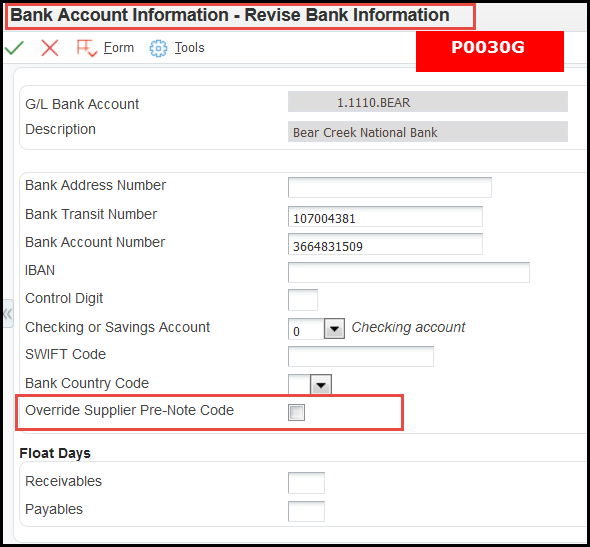

In the Work with G/L Bank Accounts (P0030G) application complete this information: , physical bank account information needs to be set up for each GL Bank Account that will be used for EFT payments. The information that is configured here includes:

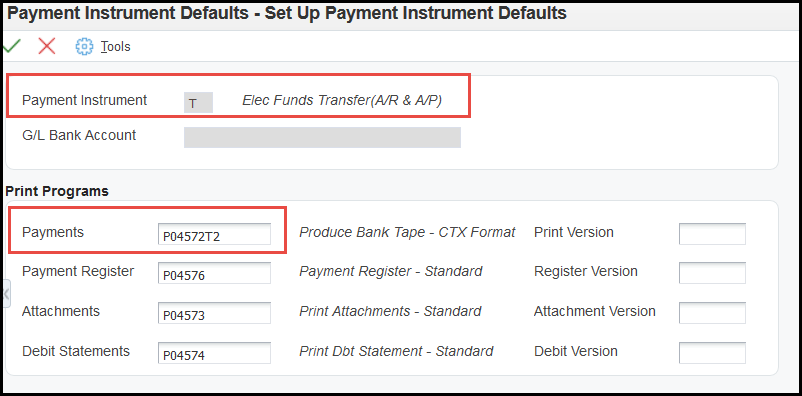

CTX Defaults

Payment Instrument (PYIN) "T" must be set up with valid Print Programs as follows:

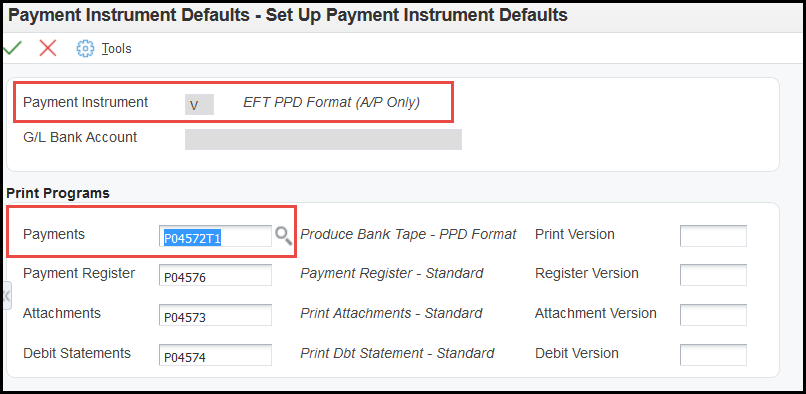

PPD Defaults

Payment Instrument (PYIN) V must be set up with valid Print Programs as follows:

IAT Defaults

Payment Instrument (PYIN) '@' must be set up with valid Print Programs as follows:

Step 1: Enter Vouchers (P0411)

After the setup is complete, vouchers can be entered into the system using any of the voucher entry programs. For more information, see knowledge Overview of Creating, Deleting or Voiding Standard Vouchers in EnterpriseOne Accounts Payable

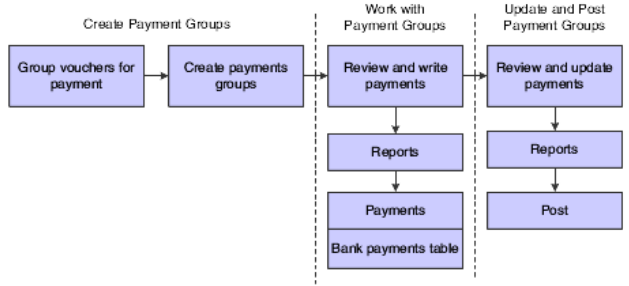

Step 2: Create Payment Control Groups (R04570)

The Bank Tape tab in the processing options of the Create Payment Control Groups (R04570) has the following options:

The Create Payment Control Groups (R04570) program automatically creates a separate payment control group for the vouchers with the following common information: bank account, payment instrument, currency code, business unit (optional), and company (optional). For more information, see knowledge How To Create Automatic Payment Control Groups (R04570, R04570)

Step 3: Work with Payment Groups (P04571)

To complete the payment process, complete the following steps using the Work with Payment Groups (P04571) application:

After EFT payments have been written to the A/P Payment Tape (F0452OW), the records can be written to a file to be transmitted to the bank. The Copy Bank File to Tape (P0457) program allows a user to review EFT payment records, delete records, and as of release 8.9 write the records to a diskette or file.

Step 4: Copy Payment To Diskette (P0457, P0457D)

Starting at release 8.9 and above only, when writing payments, the Payment Instrument (PYIN) can be in an electronic format. In this case, writing payments creates bank tape tables rather than printed payments. To complete these payments, the records need to be copied to a flat file or diskette to send the information to a financial institution. Copying payments to a diskette consists of:

Typically, your MIS department presets the detail for a tape table. This information should not be changed unless instructed to do so. However, many format specifications can be changed prior to copying the table to a diskette. The information in the bank table can be copied as long as they are not deleted from the AP Bank Tape (F0452OW) table. This might be necessary if, for example, your financial institution loses the original diskette.

The AP Payment Tape (F04572OW) table is a multi-member table, which means that each version (payment group) is a separate table. The system does not automatically delete records in the table. Instead, they must be deleted manually using the Copy Bank Tape (P0457) program.

Additional Copy Options

The following additional options for copying a tape table are available:

Processing Options - Copy Bank Tape File to Tape (P0457)

For current information on processing options, please click here to access release 9.2 online guide.

ISO 20022-to-ACH Mapping Guide & Tool

CTX - Corporate Trade Exchange (R04572T2)

The Field Inclusion Requirement code in both documents indicates which fields Oracle JD Edwards EnterpriseOne populates and which are optional.

The values are:

| Field | Description | Size | Position | Where Generated in JDE | Field Requirement |

| 1 | Record Type | 1 | 01-01 | 1 indicating record type | M |

| 2 | Priority Code | 2 | 02-03 | 1 | R |

| 3 | Immediate Destination | 10 | 04-13 | Bank Transit Number(TNST) from the Supplier's Bank Account (P0030A). Please see Bug 18474387. | M |

| 4 | Immediate Origin | 10 | 14-23 | R04572T2 Processing Option 3 Immediate Origin, tab Process. If this processing Option is left blank, the Tax ID the Tax ID for the bank account's company is used. | M |

| 5 | File Creation Date | 6 | 24-29 | Date file created in YYMMDD format. | M |

| 6 | File Creation Time | 4 | 30-33 | Time file created in HHMM format. | O |

| 7 | File ID Modifier | 1 | 34-34 | R04572T2 Processing Option 1 File ID Modifier, tab Process. | M |

| 8 | Record Size | 3 | 35-37 | 94 | M |

| 9 | Blocking Factor | 2 | 38-39 | 10 | M |

| 10 | Format Code | 1 | 40-40 | 1 | M |

| 11 | Immediate Destination Name | 23 | 41-63 | Account Description (DL01) from the G/L bank Account (P0030G) | O |

| 12 | Immediate Origin Name | 23 | 64-86 | Company Name (NAME) from Company Numbers and Names (P0010). | O |

| 13 | Reference Code | 8 | 87-94 | Not used | O |

| Field | Description | Size | Position | Where Generated in JDE | Field Requirement |

| 1 | Record Type | 1 | 01-01 | 5 indicating record type | M |

| 2 | Service Class Code | 3 | 02-04 | 200 for Debit and Credits | M |

| 3 | Company Name | 16 | 05-20 | Company Name (NAME) from Company Numbers and Names (P0010). | M |

| 4 | Co. Discretionary Data | 20 | 21-40 | R04572T2 Processing Option 5 Discretionary Data, tab Process. | O |

| 5 | Company Identification | 10 | 41-50 | R04572T2 Processing Option 4 Identification Code Designator, tab Process. If left blank, the Tax ID for the bank account's company will be used. | M |

| 6 | Standard Entry Class Code | 3 | 51-53 | CTX | M |

| 7 | Company Entry Description | 10 | 54-63 | R04572T2 Processing Option 2 Tape Payment Detail Description, Tab Process. | M |

| 8 | Company Descriptive Date | 6 | 64-69 | Date file created in YYMMDD format. | O |

| 9 | Effective Entry Date | 6 | 70-75 | Check date in YYMMDD format. | R |

| 10 | Settlement Date (Julian Date) | 3 | 76-78 | Not used by JDE. | Inserted by ACH operator |

| 11 | Originator Status Code | 1 | 79-79 | 1 | M |

| 12 | Originating DFI ID | 8 | 80-87 | First eight digits of the Bank Transit Number(TNST) from the G/L bank Account (P0030G) | M |

| 13 | Batch Number | 7 | 88-94 | Starts at 0000001 and assigned in ascending order to each batch included in transmission. | M |

Note - Each Supplier will have a record 6 within the F04572OW text file.

| Field | Description | Size | Position | Where Generated in JDE | Field Requirement |

| 1 | Record Type Format | 1 | 01-01 | 6 indicating record type. | M |

| 2 | Transaction Code | 2 | 02-03 | 22 = Automated Deposit (Checking) | M |

| 23 = Prenote for Automated Deposit (Checking) | |||||

| 32 = Automated Deposit (Savings) | |||||

| 33 = Prenote for Automated Deposit (Savings) | |||||

| Based on Chk/Sav field (CKSV) retrieved from the supplier bank account record (P0030A). | |||||

| 3 | Receiving DFI Identification | 8 | 04-11 | Bank Transit Number(TNST) from the Supplier bank Account (P0030A) | M |

| 4 | Check Digit | 1 | 12-12 | Control Digit (CHKD) form the Supplier Bank Account (P0030A) | M |

| 5 | DFI Account Number | 17 | 13-29 | Bank Account Number(CBNK) from the Supplier bank Account (P0030A) | M |

| 6 | Total Amount | 10 | 30-39 | Total amount of all checks in file (total amount of payment). | M |

| 7 | Identification Number | 15 | 40-54 | EFT Payment Number from the A/P Payment Header File ( F04572) | O |

| 8 | Number of Addenda Records | 4 | 55-58 | Total number of 6 records | M |

| 9 | Payee Name | 16 | 59-74 | Payee Alpha Name (KKALPP) from the A/P Payment Header File ( F04572) | M |

| 10 | Reserved | 2 | 75-76 | Not used by JDE and blank filled. | NA |

| 11 | Discretionary Data | 2 | 77-78 | Not used by JDE and blank filled. | O |

| 12 | Addenda Record Indicator | 1 | 79-79 | If a record 7 follows a 1 is populated otherwise it is 0. | M |

| 13 | Trace Number | 15 | 80-94 | First eight digits of the Bank Transit Number(TNST) from the G/L bank Account (P0030G) and the last seven digits of Next Number (P0002) for system 04 index 05 or Next Numbers by Company and Fiscal Year for document type PT. | M |

| Field | Description | Size | Position | Where Generated in JDE | Field Requirement | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 | Record Type Code | 1 | 01-01 | 7 indicating record type. | M | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2 | Addenda Type Code | 2 | 02-03 | 5 | M | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | Payment Related Information | 80 | 04-83 | CTX Format follows NACHA Operating Rules permit the exchange of certain EDI messages or transaction sets (e.g., 820 Payment Order/Remittance Advice) within the Addenda Records of the CTX format, but those standards are developed and maintained by other standards development organizations, such as ASC X12.

| O | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | Addenda Sequence Number | 4 | 84-87 | Line number incremented within payment in ascending order. | M | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5 | Entry Detail Sequence Number | 7 | 88-94 | last seven digits of Next Number (P0002) for system 04 index 05 or Next Numbers by Company and Fiscal Year for document type PT. | M |

| Field | Description | Size | Position | Where Generated in JDE | Field Requirement |

| 1 | Record Type Code | 1 | 01-01 | 8 indicating record type | M |

| 2 | Service Class Code | 3 | 02-05 | 220 for Credits | M |

| 3 | Entry/Addenda Count | 5 | 05-10 | Total number of 6 and 7 records | M |

| 4 | Entry Hash | 10 | 11-10 | Sum of the first 8 digits of the Bank Transit Number(TNST) from the Supplier bank Account (P0030A) from all 6 Entry Detail Records | M |

| 5 | Total Debit Entry $ amount | 12 | 21-32 | Sum of amounts from record 6 debit transactions | M |

| 6 | Total Credit Entry $ amount | 12 | 33-44 | Sum of amounts from record 6 transactions | M |

| 7 | Company Identification | 10 | 45-54 | R04572T1 Processing Option 4 Identification Code Designator, tab EFT. If left blank, the Tax ID for the bank account's company will be used. | R |

| 8 | Message Authentication Code | 19 | 55-73 | Not used by JDE and blank filled | O |

| 9 | Reserved | 6 | 74-79 | Not used by JDE and blank filled | N/A |

| 10 | Originating DFI Identification | 8 | 80-87 | Bank Transit Number(TNST) from the G/L bank Account (P0030G) | M |

| Field | Description | Size | Position | Where Generated in JDE | Field Requirement |

| 1 | Record Type Code | 1 | 01-01 | 9 indicating record type | M |

| 2 | Batch Count | 6 | 02-07 | Total number of 5 records in the file | M |

| 3 | Block Count | 6 | 08-13 | The number of physical blocks (a block is 940 characters) in the file, which includes both the File Header and File Control records. | M |

| 4 | Entry/Addenda Count | 8 | 14-21 | Total number of 6 and 7 records in the file | M |

| 5 | Entry Hash | 10 | 22-31 | Sum of corresponding fields in the Company/Batch Control Records in the file | M |

| 6 | Total Debit Entry Dollar Amount in File | 12 | 32-43 | Sum of amounts from record 6 transactions | M |

| 7 | Total Credit Entry Dollar Amount in File | 12 | 44-55 | Sum of amounts from record 6 transactions | M |

| 8 | Reserved | 39 | 56-94 | Required by ACH to be blank filled | N/A |

ISO 20022-to-ACH Mapping Guide & Tool

PPD Format PPD - Prearranged Payment and Deposits (R04572T1)

The Field Inclusion Requirement code in both documents indicates which fields Oracle JD Edwards EnterpriseOne populates and which are optional. The values are:

| Field | Description | Size | Position | Where Generated in JDE | Field Requirement |

| 1 | Record Type | 1 | 01-01 | 1 indicating record type | M |

| 2 | Priority Code | 2 | 02-03 | 1 | R |

| 3 | Immediate Destination | 10 | 04-13 | Bank Transit Number(TNST) from the G/L bank Account (P0030G) | M |

| 4 | Immediate Origin | 10 | 14-23 | R04572T1 Processing Option 3 Immediate Origin, tab EFT. If this processing Option is left blank, the Tax ID the Tax ID for the bank account's company is used. | M |

| 5 | File Creation Date | 6 | 24-29 | Date file created in YYMMDD format | M |

| 6 | File Creation Time | 4 | 30-33 | Time file created in HHMM format | O |

| 7 | File ID Modifier | 1 | 34-34 | R04572T1 Processing Option 1 File ID Modifier, tab EFT | M |

| 8 | Record Size | 3 | 35-37 | 094 | M |

| 9 | Blocking Factor | 10 | 38-39 | 10 | M |

| 10 | Format Code | 1 | 40-40 | 1 | M |

| 11 | Immediate Destination Name | 23 | 41-63 | Account Description (DL01) from the G/L bank Account (P0030G) | O |

| 12 | Immediate Origin Name | 23 | 64-86 | Company Name (NAME) from Company Numbers and Names (P0010) | O |

| 13 | Reference Code | 8 | 87-94 | Not used | O |

| Field | Description | Size | Position | Where Generated in JDE | Field Requirement |

| 1 | Record Type | 1 | 01-01 | 5 indicating record type | M |

| 2 | Service Class Code | 3 | 02-04 | 220 for Credits | M |

| 3 | Company Name | 16 | 05-20 | Company Name (NAME) from Company Numbers and Names (P0010) | M |

| 4 | Co. Discretionary Data | 20 | 21-40 | R04572T1 Processing Option 5 Discretionary Data, tab EFT | O |

| 5 | Company Identification | 10 | 41-50 | R04572T1 Processing Option 4 Identification Code Designator, tab EFT. If left blank, the Tax ID for the bank account's company will be used | M |

| 6 | Standard Entry Class Code | 3 | 51-53 | PPD | M |

| 7 | Company Entry Description | 10 | 54-63 | R04572T1 Processing Option 2 Tape Payment Detail Description, Tab EFT | M |

| 8 | Company Descriptive Date | 6 | 64-69 | Date file created in YYMMDD format | O |

| 9 | Effective Entry Date | 6 | 70-75 | Check date in YYMMDD format | R |

| 10 | Settlement Date (Julian Date) | 3 | 76-78 | Not used by JDE | Inserted by ACH operator |

| 11 | Originator Status Code | 1 | 79-79 | 1 | M |

| 12 | Originating DFI ID | 8 | 80-87 | First eight digits of the Bank Transit Number(TNST) from the G/L bank Account (P0030G) | M |

| 13 | Batch Number | 7 | 88-94 | Starts at 0000001 and assigned in ascending order to each batch included in transmission | M |

| Field | Description | Size | Position | Where Generated in JDE | Field Requirement |

| 1 | Record Type Format | 1 | 01-01 | 6 indicating record type | M |

| 2 | Transaction Code | 2 | 02-03 | 22 = Automated Deposit (Checking) | M |

| 23 = Prenote for Automated Deposit (Checking) | |||||

| 32 = Automated Deposit (Savings) | |||||

| 33 = Prenote for Automated Deposit (Savings) | |||||

| Based on Chk/Sav field (CKSV) retrieved from the supplier bank account record (P0030A) | |||||

| 3 | Receiving DFI Identification | 6 | 04-11 | Bank Transit Number(TNST) from the Supplier Bank Account (P0030A) | M |

| 4 | Check Digit | 1 | 12-12 | Control Digit (CHKD) form the Supplier Bank Account (P0030A) | M |

| 5 | DFI Account Number | 17 | 13-29 | Bank Account Number (CBNK) from the Supplier Bank Account (P0030A) | M |

| 6 | Total Amount | 10 | 30-39 | Total amount of all checks in file (total amount of payment) | M |

| 7 | Identification Number | 15 | 40-54 | R04572T1 Processing Option 6 Bank Account Reference Roll Number, Tab EFT. If left blank, the Payee Address Book Number is used. | O |

| 8 | Payee Name | 4 | 55-76 | Payee Alpha Name (KKALPP) from the A/P Payment Header File ( F04572) | M |

| 9 | Discretionary Data | 2 | 77-78 | Not used by JDE and blank filled | O |

| 10 | Addenda Record Indicator | 1 | 79-79 | If a record 7 follows a 1 is populated otherwise it is 0 | M |

| 11 | Trace Number | 15 | 80-94 | First eight digits of the Bank Transit Number(TNST) from the G/L bank Account (P0030G) and the last seven digits of Next Number (P0002) for system 04 index 05 or Next Numbers by Company and Fiscal Year for document type PT. | M |

| Field | Description | Size | Position | Where Generated in JDE | Field Requirement |

| 1 | Record Type Code | 1 | 01-01 | 7 indicating record type | M |

| 2 | Addenda Type Code | 2 | 02-03 | 5 | M |

| 3 | Payment Related Information | 80 | 04-83 | R04572T1 Processing Option 2 Tape Payment Detail Description, Tab EFT | O |

| 4 | Addenda Sequence Number | 4 | 84-87 | Line number incremented within payment in ascending order | M |

| 5 | Entry Detail Sequence Number | 7 | 88-94 | last seven digits of Next Number (P0002) for system 04 index 05 or Next Numbers by Company and Fiscal Year for document type PT. | M |

| Field | Description | Size | Position | Where Generated in JDE | Field Requirement |

| 1 | Record Type Code | 1 | 01-01 | 8 indicating record type | M |

| 2 | Service Class Code | 3 | 02-05 | 220 for Credits | M |

| 3 | Entry/Addenda Count | 5 | 05-10 | Total number of 6 and 7 records | M |

| 4 | Entry Hash | 10 | 11-10 | Sum of the first 8 digits of the Bank Transit Number(TNST) from the Supplier bank Account (P0030A) from all 6 Entry Detail Records | M |

| 5 | Total Debit Entry $ amount | 12 | 21-32 | Sum of amounts from record 6 debit transactions | M |

| 6 | Total Credit Entry $ amount | 12 | 33-44 | Sum of amounts from record 6 transactions | M |

| 7 | Company Identification | 10 | 45-54 | R04572T1 Processing Option 4 Identification Code Designator, tab EFT. If left blank, the Tax ID for the bank account's company will be used. | R |

| 8 | Message Authentication Code | 19 | 55-73 | Not used by JDE and blank filled | O |

| 9 | Reserved | 6 | 74-79 | Not used by JDE and blank filled | N/A |

| 10 | Originating DFI Identification | 8 | 80-87 | Bank Transit Number(TNST) from the G/L bank Account (P0030G) | M |

| Field | Description | Size | Position | Where Generated in JDE | Field Requirement |

| 1 | Record Type Code | 1 | 01-01 | 9 indicating record type | M |

| 2 | Batch Count | 6 | 02-07 | Total number of 5 records in the file | M |

| 3 | Block Count | 6 | 08-13 | The number of physical blocks (a block is 940 characters) in the file, which includes both the File Header and File Control records. | M |

| 4 | Entry/Addenda Count | 8 | 14-21 | Total number of 6 and 7 records in the file | M |

| 5 | Entry Hash | 10 | 22-31 | Sum of corresponding fields in the Company/Batch Control Records in the file | M |

| 6 | Total Debit Entry Dollar Amount in File | 12 | 32-43 | Sum of amounts from record 6 transactions | M |

| 7 | Total Credit Entry Dollar Amount in File | 12 | 44-55 | Sum of amounts from record 6 transactions | M |

| 8 | Reserved | 39 | 56-94 | Required by ACH to be blank filled | N/A |

The Field Inclusion Requirement code in both documents indicates which fields Oracle JD Edwards EnterpriseOne populates and which are optional. The values are:

ISO 20022-to-ACH Mapping Guide & Tool

Best resource for current IAT EFT format requirements, refer to the NACHA mapping tool link above.

Additional knowledge resources

Payment Register (R04576)

The Automatic Payment Register Report R04576 and its version are defined in Work With Payment Instruments Defaults (P0417). The Automatic Payment Register Report is called when updating a payment group in the Work With Payment Groups application P04571. When a payment group is updated, the system first launches R04575 (Update Driver) and this in turn launches the Automatic Payment Register UBE R04576. There are no processing Options for the Payment Register R04576.

Address Book Exception Report (R00311A)

The Address Book Exception Report can be accessed from the Automatic Payment Setup menu (G04411), and prints a list of address book records which:

This report prints the address number, company name, payment instrument and search type. It uses three versions to sort customers and suppliers, just customers or just suppliers. This program does not update any information. If any records appear on the exception report, you must perform one of these actions:

Additional knowledge resources