| Overview Understanding AAIs |

| Scope |

| Details |

| General Purpose Accounts (GLGxx) |

| Special Consideration for Retained Earnings Accounts (GLG4) |

| Financial Statement Totals (FSxx) |

| Overview |

| Setup FSxx AAIs |

| FS99 AAI |

| Making the Subtotals/Totals Stand Out |

| Financial Reports with Subtotals |

| Account Summarization (GLSMxx) |

| Reconcilable Ranges (GLRCxx) |

| Prior Year Account Purges (GLPRxx) |

| Speed Codes (SPx) |

| AAIs for MultiCurrency |

| Unrealized Gains and Losses on Monetary Bank Accounts (GVxxx, GWxxx, GRxxx) |

| Posting Balances by Currency (PBCxx) |

| Intercompany Settlements (ICCC and ICH) |

| Detailed Currency Restatement (CRxx, CR) |

AAIs are rules that define the relationships between your day-to-day accounting functions and your chart of accounts. In the General Accounting system, AAIs determine how to distribute general ledger entries that the system generates. The AAIs in the EnterpriseOne General Accounting system do the following:

The name of an automatic accounting instructions (AAI) item, for example, GLG is hard coded. Each AAI is associated with a specific general ledger account that consists of a business unit, an object, and optionally, a subsidiary and is mapped to your chart of accounts. Information about AAI items is setup by P0012 application and is stored in the Automatic Accounting Instructions Master table (F0012).

This document is intended for Finance Functional users who will be involved in setting up of Automatic Accounting Instructions in the General Accounting system.

The AAIs for GLGxx define account ranges for the different categories in your chart of accounts. For example, the account range for assets (GLG2) might begin with object account 1000, the account range for liabilities (GLG3) might begin with object account 2000, and so on. AAI items GLGx are used primarily for financial reporting. In absence of these AAIs, any custom financial reports using Smart fields may not print the statistical data even though it may continue to print column headings and descriptions.

The following table contains the setup considerations for AAI items GLGxx:

| AAI Item |

Purpose | Setup | Special Considerations |

|---|---|---|---|

| GLG2 | The beginning account range for assets. | Enter the object account and, if applicable, the subsidiary. | |

| GLG3 |

|

Enter the object account and, if applicable, the subsidiary. | |

| GLG4 | The account number for retained earnings. |

|

The GLG4 account number must be greater than the account number for GLG1 and less than the account number for GLG5. |

| GLG5 |

|

Enter the object account and, if applicable, the subsidiary. | This account number should indicate the last balance sheet account, which must be a non posting account. |

| GLG6 |

|

Enter the object account and, if applicable, the subsidiary. | |

| GLG7 |

|

Enter the object account and, if applicable, the subsidiary. | |

| GLG8 |

|

Enter the object account and, if applicable, the subsidiary. | |

| GLG9 | The ending account range for cost of goods. | Enter the object account and, if applicable, the subsidiary. | |

| GLG11 |

|

Enter the object account and, if applicable, the subsidiary. | Do not leave the beginning range for GLG11 (other income) blank. If you do not want to enter an account, enter the same account number as the beginning range for GLG13 (other expenses). |

| GLG12 |

|

|

Revenues (GLG6) + Expenses (GLG12) = Retained Earnings (GLG4) |

| GLG13 |

|

Enter the object account and, if applicable, the subsidiary. | If you do not want to enter an account number for the beginning range, enter the same account number as the beginning range for GLG12 (ending profit and loss accounts). |

When you produce financial statements, the system creates report subtotals based on AAI items FSxx. These AAI items, which are used for profit and loss accounts only, are optional. Do not use AAI items FSxx for accounts other than profit and loss accounts or your financial statement results will be unpredictable. Your chart of accounts must be consistent across all companies for your reports to be meaningful.

The subtotal for each AAI item (FS01 - FS98) prints after the specified account range on your financial statement. While FS01 - FS98 AAIs are available for use, along with FS99, using a small number of FSxx AAIs makes reports easier to read. Following are some of the typical subtotals that might appear on an income statement:

You can customize the text that you want to appear for each subtotal in the first description line under the heading Account Use Description on the Set Up Single AAI Item form (P0012).

It is recommended to follow below mentioned guidelines when setting up AAI item FSxx:

To define FSxx AAIs, run Automatic Accounting Instructions (P0012) application or enter AAI in Fast Path. This table shows the information needed to set up AAI item FS01:

| AAI Item | Description | Business Unit |

Object | Subsidiary | Sequence Number |

|---|---|---|---|---|---|

| FSxx | Financial Statement Totals | Not used | Required | Optional | 1.130 |

Example:

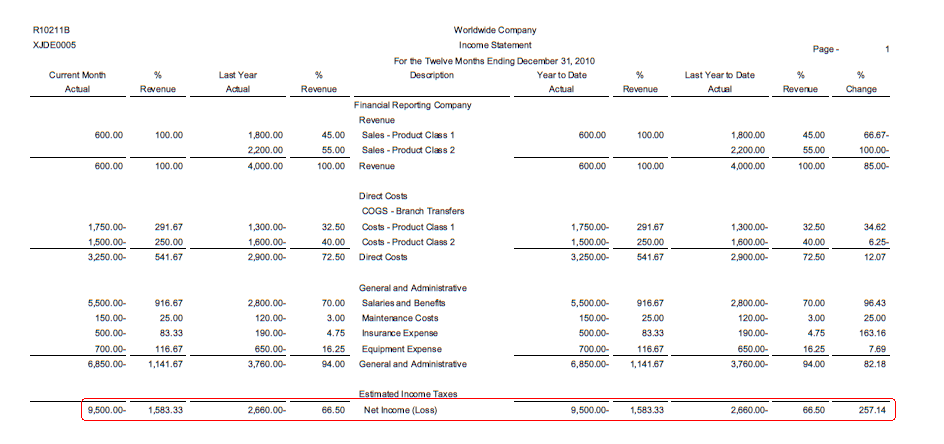

Example: FS99 AAI

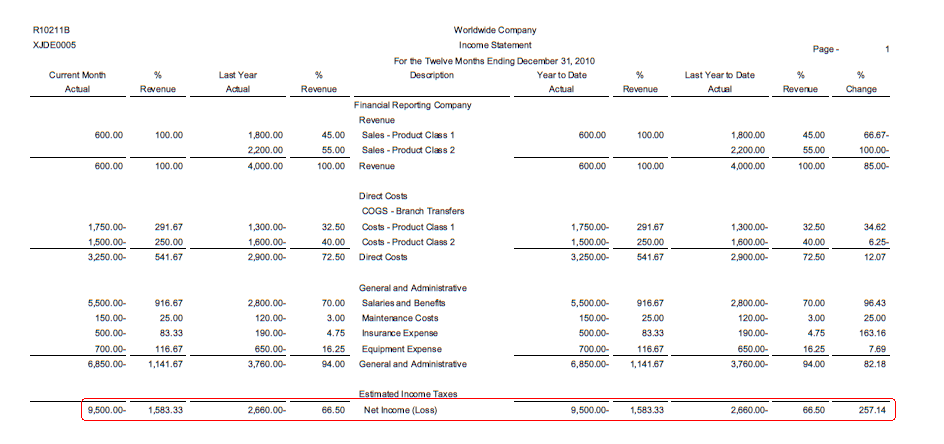

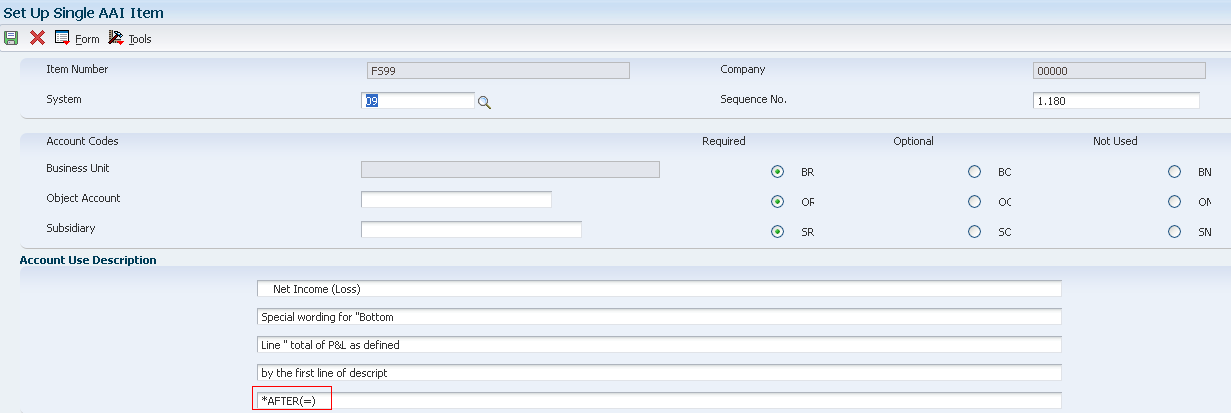

In the below shown example, the R10211B Simple Income Statement report shows an additional line of Net Income (Loss) totals corresponding to the FS99 AAI setup.

NOTE: Financial statements provide a processing option that allows you to specify whether the system calculates net income. If you calculate net income and you also set up AAI item FS99, the system prints two net income lines on the financial statement. To prevent two net income lines from printing on the financial statement, either do not set up AAI item FS99 or do not specify to calculate net income in the processing option.

To print single or double lines before or after the report totals, enter the appropriate text on the fourth or fifth line under the Account Use Description heading on the Set Up Single AAI Item form (P0012):

| Value | Description |

|---|---|

| *BEFORE(-) | Prints a single line before the totals. |

| *BEFORE(=) | Prints a double line before the totals. |

| *AFTER(-) | Prints a single line after the totals. |

| *AFTER(=) | Prints a double line after the totals. |

For each financial statement report, except Consolidated Balance Sheet (R10150) report, the EnterpriseOne General Accounting system provides a report version with subtotals based on AAI items FSxx as shown below. You must select the report version that contains the subtotals. For example, to print subtotals for AAI items FSxx on the Simple Income Statement report (R10211B), select the report version Income Statement by Branch with AAI Subtotals instead of Income Statement by Branch. Further, its suggested to use the processing options and data selection to achieve the desired output.

| Report Id | Report Version | Report Name | Version Title |

|---|---|---|---|

| R10111B | XJDE0007 | Balance Sheet | By Branch with AAI Subtotals |

| R10211B | XJDE0009 | Income Statement | Income Statement by Branch w/AAI Subtotals |

| R10412A | XJDE0006 | Monthly Spreadsheet | By Business Unit w/AAI Subtotals |

| R103121A | XJDE0003 | Consolidated Income Statement | Business Unit Consolidation with AAI Subtotals |

| R10212A | XJDE0007 | Variance Analysis | Variance Analysis All Branches w/AAI Subtotals |

| R10411A | XJDE0007 | Variance Analysis With 5 Months | Var. Ana. w/5 months By Branch w/AAI Subtotaling |

The AAI items GLSMxx define account ranges that you do not want to summarize. For example, if you do not want liquid asset accounts summarized, you might set up this account range. You must define complete ranges, consisting of a beginning and an ending AAI item. The first range must begin with GLSM01. We recommend that you end the first range with GLSM02, which is the next consecutive number. Define the next range, if needed, to begin with GLSM03 and end with GLSM04, and so on. This table shows the information needed to set up AAI item GLSMxx:

| AAI Item | Description | Business Unit (Not used) |

Object (Required) |

Subsidiary (Optional) |

Sequence Number |

|---|---|---|---|---|---|

| GLSM01 | Bypass Summarization Accounts |

NA | 1000 | Blank | 1.300 |

| GLSM02 | Bypass Summarization Accounts |

NA | 1199 | 99999999 | 1.300 |

The AAI items GLRCxx define ranges of accounts that you want to reconcile as part of your account reconciliation process. You must reconcile these accounts before you can summarize them.The Reconciled field must have a value from user defined codes (09/RC) to allow summarization. The unreconciled accounts falling under GLRCxx AAI's will be left unprocessed for summarization. You must define complete ranges, consisting of a beginning and an ending AAI item. The first range must begin with GLRC01. We recommend that you end the first range with GLRC02, which is the next consecutive number. Define the next range, if needed, to start with GLRC03 and end with GLRC04, and so on. This table shows the information needed to set up AAI item GLRCxx:

| AAI Item | Description | Business Unit (Not used) |

Object (Required) |

Subsidiary (Optional) |

Sequence Number |

|---|---|---|---|---|---|

| GLRC01 | Reconcilable Ranges |

NA | 2000 | Blank | 1.400 |

| GLRC02 | Reconcilable Ranges |

NA | 2100 | 99999999 | 1.400 |

The AAI items for GLPRxx define account ranges that you do not want to purge.You must define complete ranges, consisting of a beginning and an ending AAI item. The first range must begin with GLPR01. We recommend that you end the first range with GLPR02, which is the next consecutive number. Define the next range, if needed, to begin with GLPR03 and end with GLPR04, and so on. This table shows the information needed to set up AAI item GLPRxx:

| AAI Item | Description | Business Unit (Not used) |

Object (Required) |

Subsidiary (Optional) |

Sequence Number |

|---|---|---|---|---|---|

| GLPR01 | Bypass Purge Accounts |

NA | 3000 | Blank | 1.440 |

| GLPR02 | Bypass Purge Accounts |

NA | 3100 | 99999999 | 1.440 |

The AAI items for SPx define one-character speed codes that you can use instead of the standard combination of business unit.object.subsidiary for a general ledger account.

You can use a speed code to replace the entire business unit.object.subsidiary, the object number and subsidiary, or the object number only. You cannot set up a speed code to replace only the subsidiary.

Following table shows the information needed to set up AAI item SPx:

| AAI Item | Description | Company | Business Unit (Not used) |

Object (Required) |

Subsidiary (Optional) |

Sequence Number |

|---|---|---|---|---|---|---|

| SPx | Speed Code | 00001 | Optional | Required | Optional | 1.289 |

The 'x' character in the speed code item is a user-defined single character. We recommend that you use only alphabetic characters (letters A–Z) if your business units are numeric.

After you set up speed codes, you must exit and then restart your EnterpriseOne system before you can enter speed codes instead of account numbers.

If you use a flexible format for your chart of accounts, you cannot use speed codes.

Example: Assume that you set up AAI item SPB and define only the object account (1110) as a speed code. During data entry, you type a business unit and, if appropriate, a subsidiary. For example, if you enter 1.B, the system reads it as 1.1110.

You set up AAIs to define accounts for multicurrency processing in the EnterpriseOne General Accounting system for:

When the system calculates unrealized gains and losses on monetary accounts, posts account balances by currency, and restates amounts in a different currency, it uses AAIs to distribute the amounts to the correct general ledger accounts.

Some AAI items have a suffix of xxx to accommodate a three-character currency code. You use the xxx suffix to set up multiple currency-specific AAI items for each company. If you do not specify a currency code, the system uses the currency code of the company as the default.

You can set up AAIs for company 00000, or you can set up specific AAIs for an individual company. Each AAI item in the EnterpriseOne system has a hierarchical order by which the system locates an account number. This is an example of a hierarchical order:

If you work with currency specific monetary bank accounts and foreign currencies, you need to periodically revalue the bank accounts to reflect current exchange rates. The system calculates the current domestic amount of a foreign currency balance to determine an unrealized gain or loss. In this way, it determines what the gain or loss would be if you converted the balance of the foreign currency bank account to the domestic currency. Following AAI items define the accounts that the system uses for unrealized gains and losses on monetary accounts:

where xxx represents the currency code and is optional.

Rules

The following rules apply to these AAI items GV, GW, and GR:

AAI Sequence

The sequence in which the system searches for GV and GW is:

AAI item PBCxx defines the account ranges that the system uses to track and post balances by currency in the Account Balances table (F0902). If you post balances by currency for a company, you must set up AAI item PBCxx as well as select the Post Balance by Currency check box in the Company Names & Numbers program (P0010).

Rules

Following rules apply to AAI item PBCxx:

Example: PBCxx Setup

Company 00070 posts balances by currency for all accounts. The retained earnings object account is 4980. To exclude account 4980, set up four AAI items for PBCxx and two ranges as shown in this table:

| AAI Item | Description | Business Unit (Not Used) |

Object (Required) |

Subsidiary (Optional) |

|---|---|---|---|---|

| PBC01 | Post Balances by Currency - Beginning Account Range 1 |

NA | 1000 | Blank |

| PBC02 | Post Balances by Currency - Ending Account Range 1 |

NA | 4979 | 99999999 |

| PBC03 | Post Balances by Currency - Beginning Account Range 2 |

NA | 4981 | Blank |

| PBC04 | Post Balances by Currency - Ending Account Range 2 |

NA | 9999 | 99999999 |

Similarly you can define up to 49 ranges for Post Balances by Currency.

You create intercompany settlements to ensure that each company's net balance equals zero. You can choose from following methods of intercompany settlements:

After you set up the intercompany settlement accounts for each company, you can reference these accounts in the intercompany AAIs. Thus, the system knows the accounts for which to create balancing entries during the post. The two AAI items for intercompany settlements are ICCC and ICH. You use ICCC for all intercompany settlements. Additionally, you use ICH for the hub method.

Hub Method

For the hub method, you use both of the intercompany settlement AAIs - ICH and ICCC.

Detail and Configured Hub Methods

For the detail and configured hub methods, you use only AAI item ICCC.

ICH (Intercompany Hub)

This item defines the hub company. Observe these guidelines when setting up AAI item the ICH:

ICCC (Intercompany Business Unit)

This item defines the non-hub companies. Observe these guidelines when setting up AAI item the ICCC:

Example: AAIs for the Hub Method

This example shows the AAI items ICH and ICCC with separate items for ICCC:

| AAI Item | Company | Business Unit (Required) |

Object (Required) |

Subsidiary (Optional) |

|---|---|---|---|---|

| ICH | 00000 | 1 | 1291 | Blank |

| ICCC | 00200 | 200 | 1291 | Blank |

| ICCC | 00050 | 50 | 1291 | Blank |

Example: AAIs for the Detail and Configured Hub Methods

This example shows the recommended AAI setup:

| AAI Item | Company | Business Unit (Required) |

Object (Required) |

Subsidiary (Optional) |

|---|---|---|---|---|

| ICCC | 00001 | 1 | 1291 | Blank |

| ICCC | 00200 | 200 | 1291 | Blank |

| ICCC | 00050 | 50 | 1291 | Blank |

In case you have setup Detailed Currency Restatement (R11411) as the Restatement Method, setup the following AAI's:

AAI Item CRxx (Required)

Following rules apply to AAI items CRxx:

The system uses the account ranges assigned to AAI items CRxx to restate amounts in another currency.

xx is used in pairs and represents the beginning and end of a range. For example, CR01 represents the first account in a range and CR02 represents the last account in that range.

You can define up to 48 ranges.

Ranges cannot be skipped and must be this sequential order:

01–02 = first range of accounts

03–04 = second range of accounts

To restate the entire chart of accounts, use only one pair:

CR01 = Object account 1000

CR02 = Object account 999999.99999999 or 999999.ZZZZZZZZ (depending on the operating system)

The business unit is optional. If you leave the Business Unit field blank, the system uses the business unit of the account number on the transaction.

The sequence numbers for AAI items CRxx are 11.620 and 11.630, and they do not fall within the sequence numbers for General Accounting.

AAI Item CR (Optional)

Following rules apply to AAI item CR:

The system uses the account assigned to AAI item CR to create balancing entries that might be required due to rounding differences.

You set up this AAI item only if you restate the entire chart of accounts into the XA ledger along with the YA and ZA ledgers, if applicable, and require the ledger to balance.

The account assigned to this AAI item keeps track of the journal entries created to balance the currency restatement ledgers.

Set up this AAI item only if you set a processing option to create balancing journal entries when you run the Detailed Currency Restatement program. If the processing option is set to create balancing entries and the AAI item does not exist, the system generates an error report when you run the Detailed Currency Restatement program.

The business unit.object.subsidiary is required.

The sequence number for AAI item CR is 11.610, and it does not fall within the sequence numbers for General Accounting.

NOTE: To calculate gains and losses and restate the amounts in the alternate ledger (XA), the system uses these AAI items: