| Purpose |

| Overview |

| Scope |

| Details |

| Program Functionality |

| Closing Fiscal Year for Budget Ledger Types |

| Specific Considerations |

| Retained Earnings |

| Intercompany Settlements |

| Balance Sheet Entries |

| Setup |

| Prerequisites |

| Processing Options |

| Data Selection |

| Data Sequence |

| Reviewing the Report |

| Common Error Messages |

| Frequently Asked Questions |

As part of your year-end procedures, you must close your books for the fiscal year. To close your books, you close the following systems on the Company Setup form:

After you close the fiscal year for these systems, you should run the Annual Close program (R098201). This sequence is suggested to prevent users from posting to the fiscal year while you are running the program or after you have completed running the program. Changing this sequence can cause integrity issues such as out-of-balance issues.

This document provides an overview of the Annual Close Report (R098201), including the overview of functionality, setup requirements, information on reviewing the annual close report and common error messages.

The Annual Close program (R098201) does the following:

When you close a fiscal year, you can roll the original budget amounts in the F0902 table to the next year for budget ledger types, such as:

You control how to "Roll" the balance in the budget to the next fiscal year using:

If you check the option "Roll Original Budget to Next Year" in Ledger Type Rules Setup (P0025), and run the Annual Close program with Original Budget processing option as '1', the program will generate new Account Balance records with the budget amount that was established for the previous year for that ledger type. The program simply copies amounts in the Original/Beginning Budget (BORG) field on the Account Balance record for the fiscal year being closed to the Original/Beginning Budget (BORG) field on the Account Balance record for the next fiscal year. For more information on setting up Ledger Types, refer to Setting up Ledger Type.

If you leave the option unchecked, a balance record will be generated, but amounts will not be copied.

Depending on how often you redefine your budgets, rolling the budget amounts forward could reduce the amount of time you spend establishing new budgets.

AAI item GLG4 defines the account that the system uses for the retained earnings of each company. The account must be a posting account that allows machine-generated entries. During the annual close, the system posts retained earnings to the account assigned to AAI item GLG4.

You can close more than one company to a single retained earnings account. This procedure is necessary if corporate divisions are set up as companies. You would close these divisions to a single retained earnings account to consolidate reporting for the legal corporate entity. If you are closing multiple companies to the same retained earnings account, ensure the following:

By setting a processing option, you can print a detailed list of the accounts and balance amounts that are used in the retained earnings calculation. This is useful if you need to research an incorrect retained earnings amount. The detailed list for retained earnings can be lengthy. Do not print it unless you need to research the retained earnings calculation.

After you run the Annual Close program, you might need to create journal entries for intercompany settlements to keep the companies in balance. The Annual Close program posts retained earnings to a retained earnings account for a single company but does not create automatic entries for intercompany settlements.

If you close a fiscal year and later find out that you must create entries for balance sheet accounts for that year, you do not have to reopen the year (that is, change the current period back to the prior year ending period) and rerun the Annual Close program. Instead, create the entries for document type ## (prior year transactions) using the Journal Entry program (P0911). The system generates a warning message but accepts the transactions. Post the transactions as usual. The system updates the beginning balance forward amounts in the F0902 table for the balance sheet accounts affected. Because the entries are balance sheet entries, they do not impact the retained earnings account so there is no need to reopen the fiscal period and year and run the Annual Close program.

Setup Requirements

| Setup | Description |

|---|---|

| Chart of Accounts | Following accounts must be set up:

|

| Automatic Accounting Instructions (AAIs) |

Following AAIs items must be set up:

|

| Ledger Types | Ledger type AA and all Budget ledger types must be set up in UDC table 09/LT and on the Ledger Type Rules Setup form (P0025). For the AA ledger, select following check boxes on the Ledger Type Rules Setup form:

|

Common Tasks

The specific process for closing a fiscal year is unique for each company. Each organization should develop its own year-end detailed closing tasks and include them in internal documentation. Before closing the fiscal year, you may want to perform following tasks appropriate for your company:

Now you are ready to run the Annual Close program.

Profit/Loss Tab

Profit/Loss

Orig Budget Tab

Original Budget

Print Tab

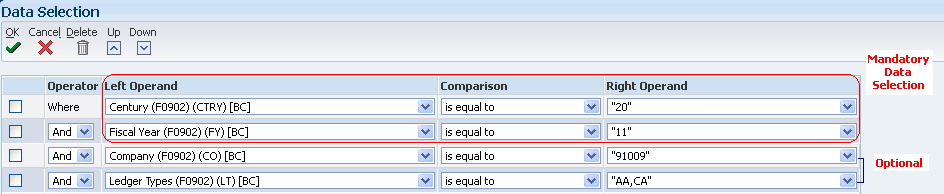

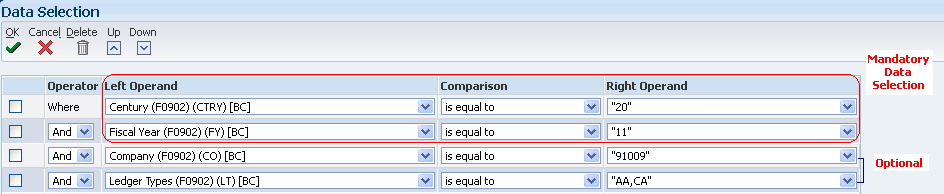

It is mandatory that the Data Selection includes Century with a particular Fiscal Year. Further, data selection by Company and Ledger Type are optional.

Do not change the Data Sequence setup. The default sequence is by Fiscal Year, Company and Ledger Type. Changing the Data Sequence could damage the F0902 file and/or produce unpredictable results.

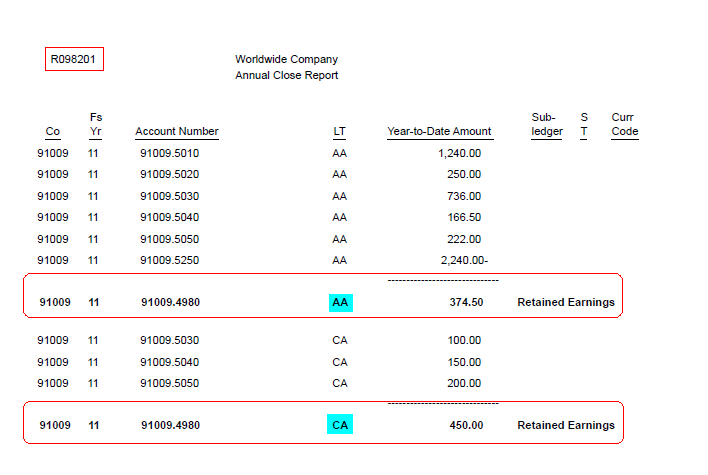

The Annual Close report (R098201) sums all Income Statement (Profit\Loss) accounts (object accounts from GLG6 to GLG12 AAIs) and populates the Balance Forward field (APYC) field and Prior Year Net Postings (APYN) values in the retained earnings account i.e. 91009.4980 for ledger types - AA and CA. It also creates account balance records in the F0902 table for the fiscal year 12 for ledger types AA and CA for all income statement and balance sheet accounts and updates the Balance Forward (APYC) and Prior Year End Net Posting (APYN) fields for the same.

If any errors prevent a company from closing, the errors are listed on a report. Examples of errors and resolutions include:

| Error Message | Resolution |

|---|---|

| Company not closed. Retained earnings account or AAI (GLG4) not set up. | Set up a valid retained earnings account corresponding to AAI item GLG4 with Posting Edit Code of 'M'. |

| Company not closed. Beginning P/L AAI (GLG6) not set up. | Set up AAI item GLG6 for company 00000 to define your beginning revenue (profit and loss) account. |

For frequently asked questions, please refer to Frequently Asked Questions on the Annual Close Report (R098201).